Give Through Payroll Deduction

Follow the payroll deduction instructions below and contact Annual Giving at giving gwu [dot] edu (giving[at]gwu[dot]edu) with any questions. Please note your payroll deduction will remain in effect until you return to GWeb and change the gift status to inactive.

gwu [dot] edu (giving[at]gwu[dot]edu) with any questions. Please note your payroll deduction will remain in effect until you return to GWeb and change the gift status to inactive.

Payroll Deduction Instructions

- Log into GWeb.

- Click "Access Employee Dashboard"

- Click "Deductions"

- Click "Other Deductions"

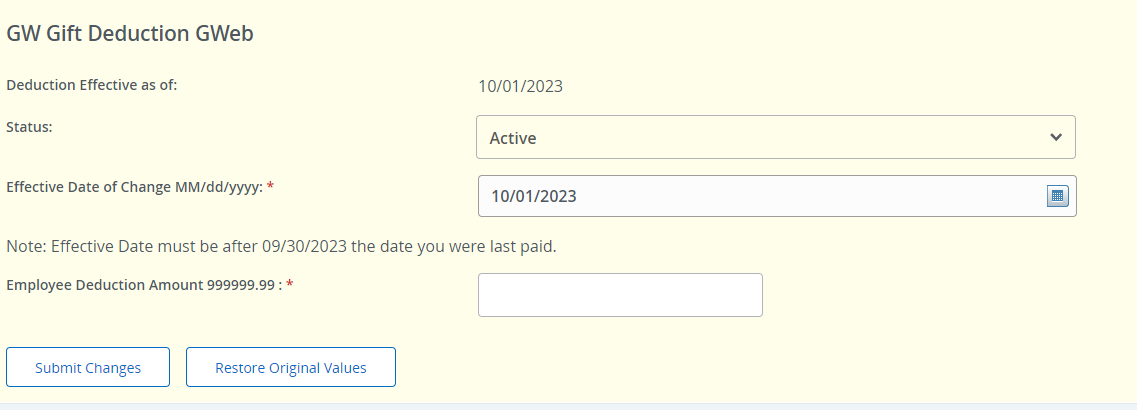

- View GW Deductions

- Add a New Benefit or Deduction

Post-Submission Follow-Up

Thank you for making a sustaining gift to GW through a payroll deduction. Your gift may take one to two pay periods to process. After the first payroll deduction gift is processed, the GW Annual Giving team (giving gwu [dot] edu) will email you to select a gift designation option. You may designate your gift to any GW fund. If you would like to make any changes to your payroll deduction gift or cancel your gift, please email giving

gwu [dot] edu) will email you to select a gift designation option. You may designate your gift to any GW fund. If you would like to make any changes to your payroll deduction gift or cancel your gift, please email giving gwu [dot] edu.

gwu [dot] edu.